When a company is setup for deferred GST, the company will receive their BAS statement one week after the BAS period has ended.

To setup an interface record for deferred GST, complete the steps in the previous topic, "Setting up GL Interface Records for Import Costing", making sure that you name the interface record "DEFERREDGST" (with no spaces).

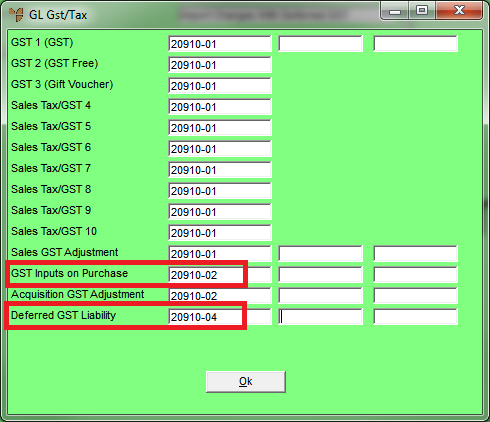

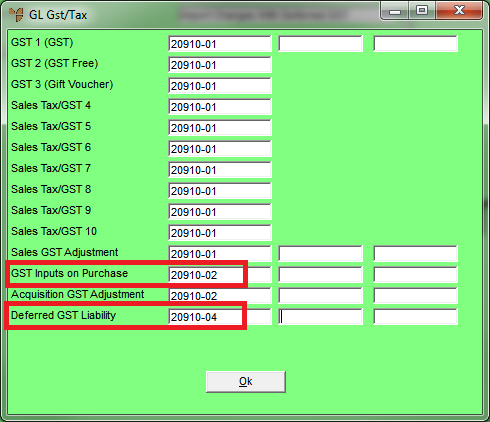

On the GL Gst/Tax screen, you must complete both the GST Inputs on Purchase account and the Deferred GST Liability account.

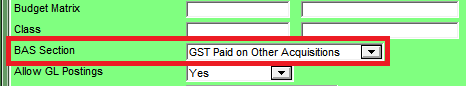

The GST Inputs on Purchase account must have a BAS flag of GST Paid on Other Acquisitions.

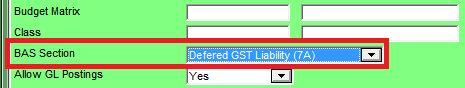

The Deferred GST Liability account must have a BAS Section flag of Deferred GST Liability (7A).

|

|

|

Reference To setup GL accounts and their BAS flags, see "File - GL Accounts - GL Account" in the General Ledger manual. |

When an import cost batch with deferred GST is posted costed (or the uncosted batch is reconciled), Micronet makes the following postings:

|

GL Account |

Movement Type |

Amount Used |

|---|---|---|

|

GST Inputs on Purchase |

Increase (debit) |

Deferred GST Amount (Current Period) |

|

Deferred GST Liability |

Decrease (credit) |

Deferred GST Amount (Current Period) |